Fund of qualified investors

Registers the Fund in the list of investment funds, supervises the activities of the Fund, the investment company and the depositary bank, requires regular reports on the Fund’s economic management, and imposes sanctions in case of violations of the rules.

It is a qualified investor fund pursuant to Section 154 of Act No. 240/2013 Coll., on investment companies and investment funds (ZISIF), under the supervision of the CNB and the depository.

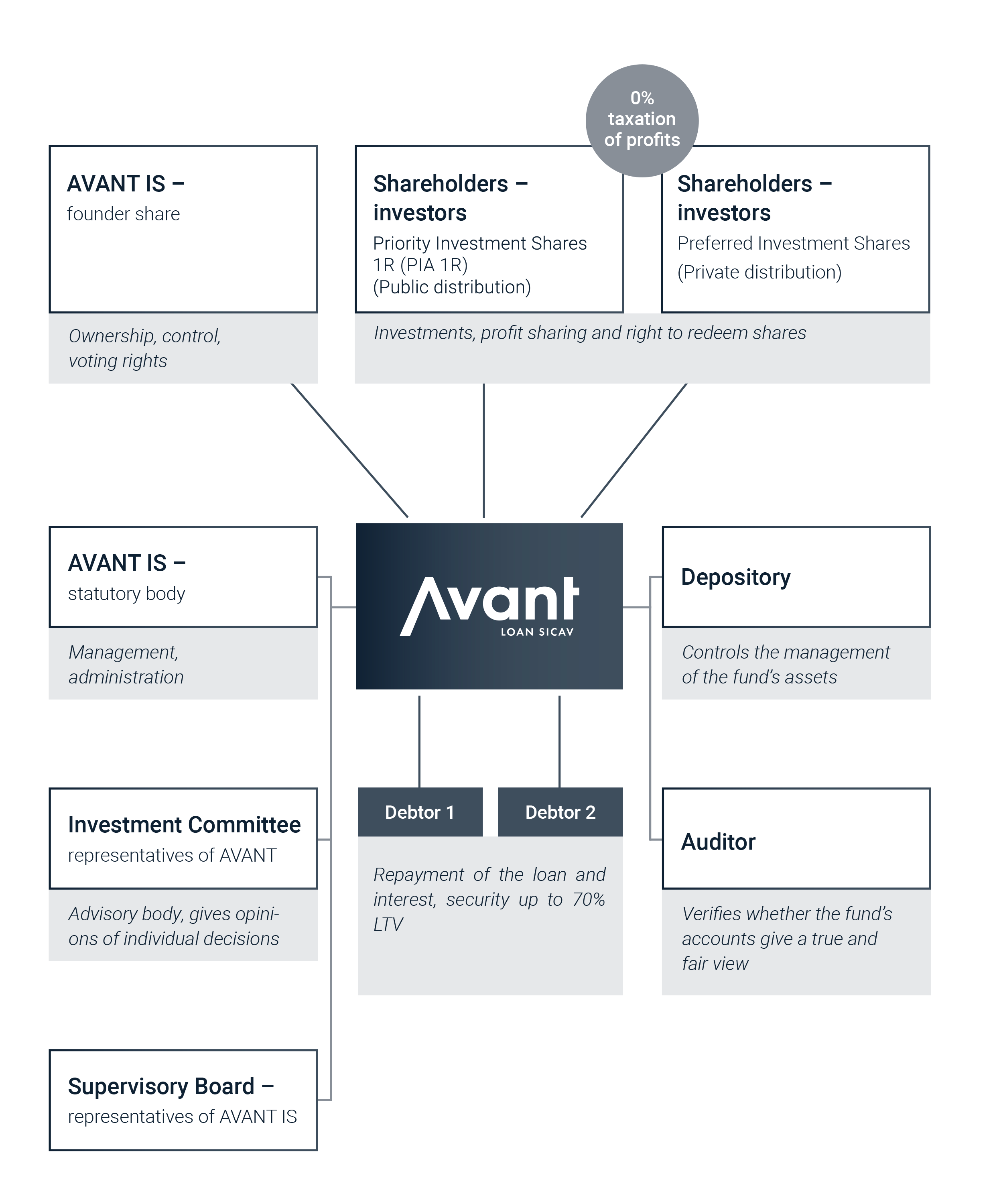

An analysis of economic profitability (AEV) is prepared for each investment project, the investment is further assessed by the Investment Committee and the final decision is made by the Fund’s Assets Management Director. The investment company manages the Fund’s assets according to the Fund’s statutes and in accordance with the ZISIF, acts on its behalf, signs contracts on behalf of the Fund, fulfils the Fund’s obligations towards the state administration (accounting, taxes), the CNB (monthly reporting of financial statements, information on changes) and the depositary bank. The activities of the investment company are continuously monitored by the depository and the CNB.

The basic document of the Fund defining the investment strategy, investment limits, Fund’s economic management rules, the method and frequency of calculation of the value of the investment share and the Fund’s total cost ratio, specifying the scope of the depositary’s activities and information obligations of the Fund.

AVANT investiční společnost, a.s. specialises in the establishment and management of qualified investor funds. In recent years, AVANT has become the most dynamically growing investment company in the Czech Republic and is currently the largest investment company in the qualified investor fund market in the Czech Republic. AVANT investiční společnost, a.s. manages more than 212 investment funds and subfunds with total assets value exceeding CZK 181.3 billion (as of 30 June 2025). AVANT has gained its position on the market primarily through its personal client approach, experience, flexibility and quality of services provided. The managed funds invest in commercial real property, residential projects, agricultural land, claims, works of art and property participations in start-up projects or existing companies, which it helps to further develop.

AVANT LOAN SICAV, a.s. is a qualified investor fund. Only a qualified investor within the meaning of Section 272 of Act No. 240/2013 Coll., as amended, on investment companies and investment funds as amended, may become an investor of the Fund. The investment company advises investors that the value of an investment in the Fund may go down as well as up and the return on the amount originally invested is not guaranteed. The performance of the Fund in previous periods does not guarantee the same or better performance in the future. An investment in the Fund is intended to provide a return when held over the medium to long term and is therefore not suitable for short-term speculation. In particular, potential investors should consider the specific risks that may arise from the Fund’s investment objectives as set out in its Statutes. The investment objectives are reflected in the recommended investment horizon, as well as in the fees and costs of the Fund.

The Fund’s Key Information Document (KID) is available at www.avantfunds.cz/informacni-povinnost.

The said information can be obtained in paper form at the registered office of AVANT investiční společnost, a.s., City Tower, Hvězdova 1716/2b, 140 00 Prague 4.

More information on the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) can be obtained at www.avantfunds.cz/dulezite-informace.